Dmytro Varavin/iStock via Getty Images

Population growth trends: Demography has been a hot topic lately, with seemingly opposing forces on the one hand arguing for higher population growth to avoid population collapse, and still others essentially arguing for depopulation to avoid climate catastrophe in their quest for sustainability.

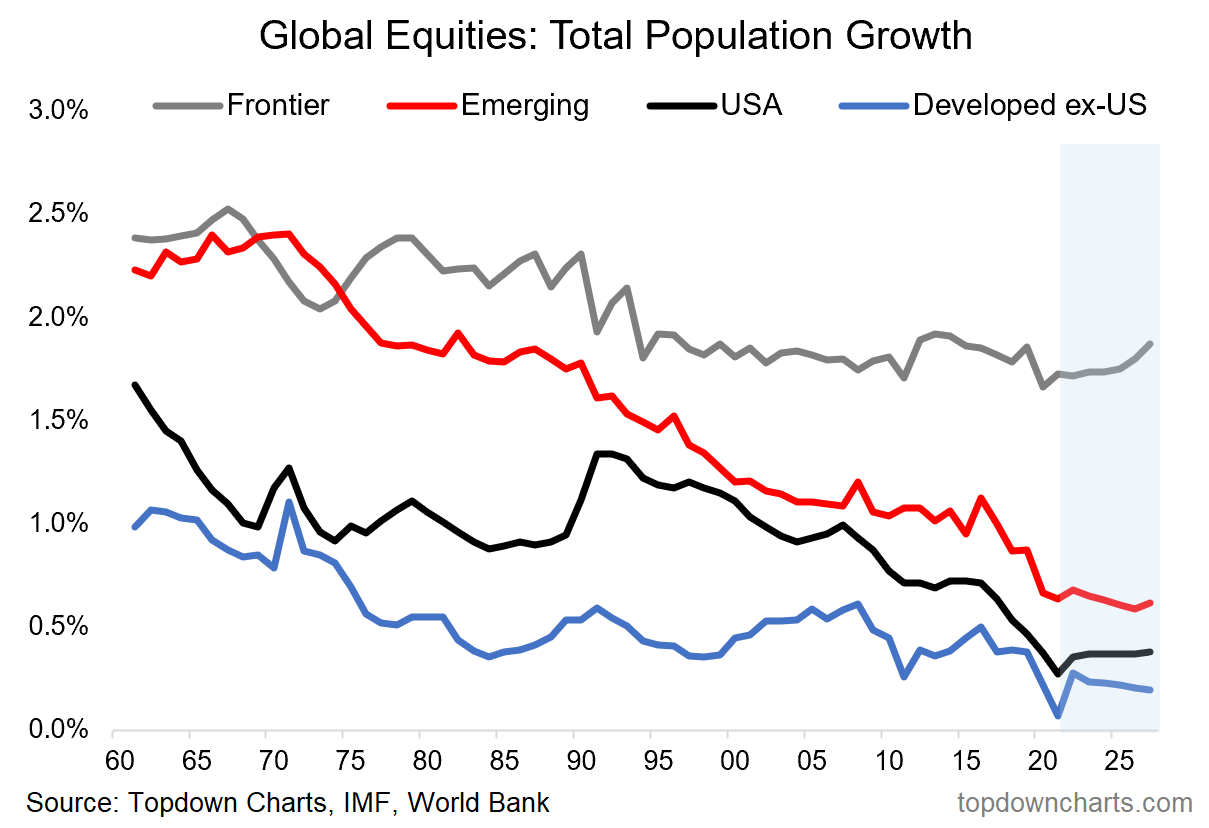

We try to avoid ideological debates and focus on the facts here, especially when it comes to investment conclusions: which is our main job. The chart below is an exercise in assessing the facts in terms of population growth in the major country groups within global equities.

What is striking and interesting is both the trend vs level aspect as well as the apparent divergence vs convergence between these disparate groups.

Older developed economies (think Europe, Japan) are at the bottom of the growth rankings, while the United States has converged on them after having topped for a while. Even previous fast-growing emerging markets have tended to fall towards this group. There’s a theme there (slowing overall population growth).

But perhaps what stands out most are the frontier markets: higher than the others and expected to remain high. Frontier has the demographic advantage, and that matters because the potential for economic growth (and, ultimately, the potential for earnings growth) depends on a combination of population growth and productivity growth.

So a very intriguing chart indeed, in general, but especially for global equities and asset allocation strategy. The 2022 global equity bear market will certainly bring opportunities as valuations fall, and it’s insights like this that will help prioritize where to look for long-term investors.

Descending charts

Key point: Population growth is slowing everywhere in the world (except frontier markets).

Chart methodological notes: Country groupings are consistent with MSCI country classifications, data are from the IMF (including projections) and the World Bank (which each aggregate data from other sources). Growth rates are based on the total population within each of the country groups.