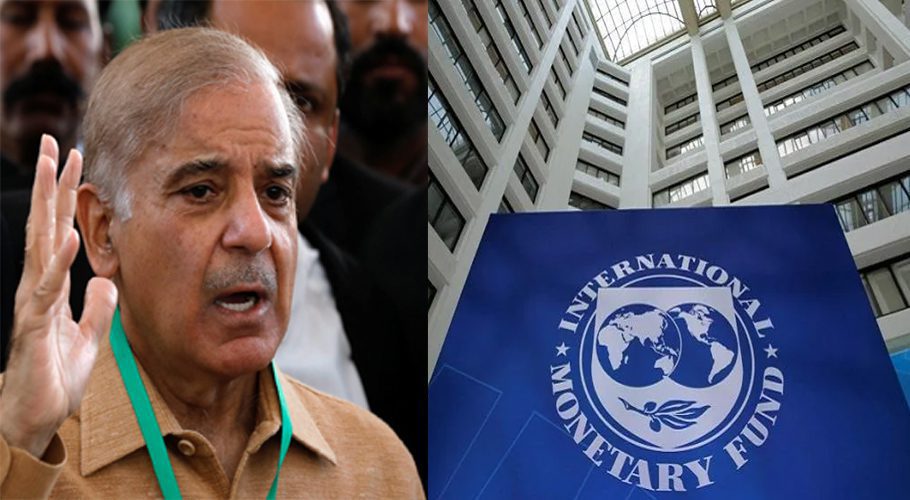

ISLAMABAD: The federal government has backtracked on its decision to exempt middle-income groups from tax, bowing to the demands of the International Monetary Fund (IMF). Miftah Ismael called Friday’s decision necessary for the release of the IMF’s $1 billion tranche.

In order to bridge the revenue gap, the government decided to further narrow the working class by raising tax rates to collect Rs 35 billion from this already struggling part of the population.

According to the details, following an agreement reached with the IMF, the government has introduced a slice of Rs600,000 to Rs1.2 million and those who are part of it will have to pay a tax of 2.5% on their income.

People whose income is between Rs1.2 million and Rs2.4 million, there will be a fixed tax of Rs 15,000 and an additional tax of 12.5% on income. A tax of 20% and 165,000 rupees will be payable by those with incomes between 2.4 and 3.6 million rupees.

For income between 3.6 and 6 million rupees, a tax of 25% will be imposed as well as a fixed payment of 405,000 rupees.

Those who earn between 6 and 12 million rupees will have to pay a fixed amount of more than 1 million rupees in addition to 32.5% income tax, while those with an income above 12 million rupees will pay income tax of 35% as well as a fixed amount of 2.9 million rupees. The new tax slabs will be applicable from July 01.

Earlier, the government announced in the budget that 100 rupees would be charged to people with personal incomes of up to 1.2 million a year, providing great relief to the salaried class whose annual incomes are below 1.2 million.