Zimmer Biomet Holdings, Inc. ZBH recently signed an exclusive, multi-year co-marketing agreement with Surgical Planning Associates, Inc. to market the FDA-cleared HipInsight mixed-reality navigation system for total hip replacement. The new mixed reality navigation system was specifically designed for Zimmer Biomet’s hip implant portfolio.

HipInsight is the newest addition to the OptiVu Mixed Reality app portfolio. This addition has enhanced the capabilities of the ZBEdge suite of integrated smart, digital and robotic technologies, which aim to deliver transformative data-driven insights to optimize patient outcomes.

According to Zimmer Biomet management, the addition of HipInsight to the mixed reality portfolio has reinforced the company’s commitment to transforming the surgical experience with the latest innovative technologies that help surgeons improve accuracy, seek better results and optimize efficiency during total hip arthroplasty.

The latest collaboration will see Zimmer Biomet provide surgeons with a sophisticated and proven mixed-reality-based visualization tool designed specifically for exclusive use with its line of hip implants.

Learn more about HipInsight

The HipInsight uses Microsoft HoloLens 2 glasses to help surgeons visualize a hologram of the patient’s pelvic anatomy. The hologram will be projected onto the pelvis to aid placement and alignment of the implant during surgery. The HipInsight is different from other traditional intraoperative surgical navigation systems that provide information on flat screens out of sight of the surgeon.

The HipInsight system creates a detailed 3D surgical plan based on computed tomography (CT) that consists of details crucial for precise and efficient implant placement, including planned component sizes, pelvic tilt, legs and shift shift. The HipInsight system leverages mixed reality glasses and the position of an intelligent recording tool to overlay real-time holograms on patient anatomy during surgery. This will help surgeons pursue the surgical plan in direct view.

Image source: Zacks Investment Research

Surgical Planning Associates management mentioned that the latest collaboration is part of the company’s journey to establish mixed reality-based surgical guidance as the standard of care in orthopedics.

Industry Outlook

Compared published in GlobeNewswire, the global hip replacement market is expected to grow at a CAGR of 5.3% during the period 2021-2028. Factors such as increasing incidence of osteoarthritis, increasing geriatric population, and improving patient knowledge regarding hip replacement surgeries can be attributed to the growth of the market.

Given the significant market outlook, Zimmer Biomet’s latest agreement to commercialize HipInsight seems timely.

Other Notable Developments

Zimmer Biomet is seeing a steady recovery across all businesses in 2022.

In the second quarter of 2022, the company reported growth of 11.2% in the Knee business, driven by a strong recovery in knee procedures in most regions. Within the Hips business, easier comparisons outside of the US and a strong pick-up in international proceedings drove growth.

Zimmer Biomet’s international sales increased 12.2% on strong procedure volume in most markets in EMEA and APAC. Meanwhile, U.S. sales rose 1.3%, driven by a strong recovery in execution as COVID cases declined and elective procedures returned, particularly to knees and hips .

Share price performance

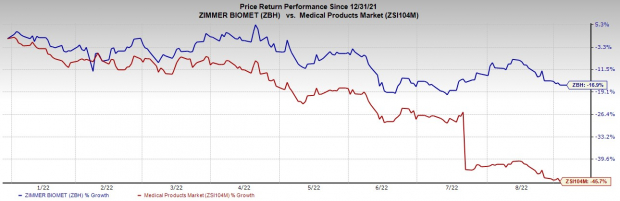

The stock outperformed its industry Last year. It lost 16.9% compared to the industry’s 45.7% drop.

Zacks Ranking and Key Picks

Currently, Zimmer Biomet carries a Zacks rank #3 (Hold).

A few higher ranked stocks in the broader medical space that investors can consider are AMN Healthcare Services, Inc. AMN, ShockWave Medical, Inc. SWAVs and McKesson Corporation MCK.

AMN Healthcare has a long-term earnings growth rate of 3.2%. The company has beaten earnings estimates in the past four quarters, delivering an average 15.7% surprise. It currently boasts a Zacks rank #1 (Strong Buy). You can see the full list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has outperformed its industry over the past year. The AMN lost 17.4% against a drop of 30.7% for the industry.

ShockWave Medical, currently No. 1 Zacks, has an estimated growth rate of 33.1% for 2023. The company’s earnings have exceeded estimates for the past four quarters, averaging 180.1%.

ShockWave Medical has outperformed its industry over the past year. SWAV gained 63.8% against the industry’s 32.3% drop over the past year.

McKesson has an estimated long-term growth rate of 9.9%. The company has exceeded earnings estimates in the past three quarters and missed one, delivering a 13% surprise on average. He currently wears a Zacks Rank #2 (Buy).

McKesson has outperformed its industry over the past year. MCK gained 46.4% against an industry decline of 13.3%.

5 shares ready to double

Each was handpicked by a Zacks expert as the #1 preferred stock to earn +100% or more in 2021. Previous recommendations have skyrocketed +143.0%, +175.9%, + 498.3% and +673.0%.

Most of the stocks in this report fly under the radar on Wall Street, which provides a great opportunity to get in on the ground floor.Today, check out these 5 potential home runs >>

McKesson Corporation (MCK): Free Stock Analysis Report

AMN Healthcare Services Inc (AMN): Free Inventory Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH): Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV): Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.