Even as asset values and wealth are compressed in the current economic environment of inflation, rising interest rates and possible recession, estate planning lawyers look beyond current market conditions for timing. .

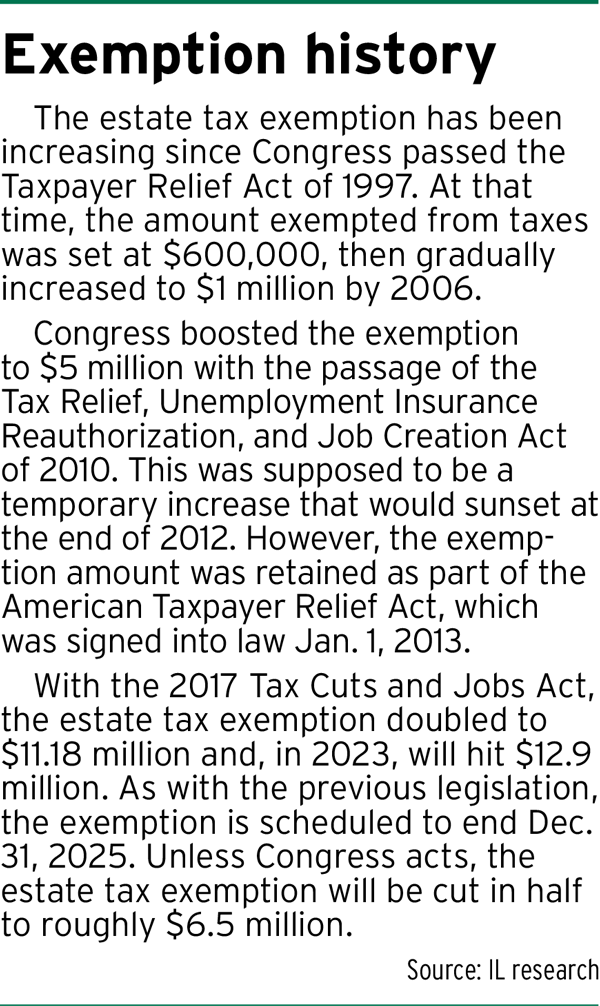

An estate tax exemption that doubled to more than $12 million per person under the 2017 Tax Cuts and Jobs Act is set to be cut in half by the end of 2025. Individuals and couples whose assets exceed the exemption avoid the impending tax hike by transferring their wealth through gifts to their children and grandchildren.

The wild card in this situation is Capitol Hill. Congress could change the exemption provision, either by extending the sunset or, perhaps, by making an even steeper reduction. Estate planning lawyers advise their clients to plan as if the exemption would amount to $6 million on January 1, 2026.

“We don’t know what they’re going to do, but we know what’s going to happen if they don’t,” said Greg Duncan, partner at Dentons Bingham Greenebaum. “Lately, Congress has done nothing.”

Advocates acknowledge that households with enough money to qualify for the exemption are not at risk of financial ruin if the exemption expires. Yet they must educate, counsel, and exercise patience as clients decide what to do and when.

These decisions vary. Some determine who will receive the gifts while others with assets in the $15-20 million range think carefully about how much they can comfortably give away while maintaining their lifestyle. Conversely, many whose assets are invested in their small business sell despite the decline in the value of their business due to the downturn in the market.

“So there’s a lot of things going through people’s minds,” Duncan said. “But I think overall, for those who can afford it, donations are happening at a blistering pace from last year and this year. There have been many generational transfers of wealth to children and grandchildren.

The opportunity is now

John Olivieri, a partner at Barnes & Thornburg, admitted he was a little confused when the financial adviser of a client whose net worth was below the exemption level pushed to give away some of the assets.

The lawyer suggested the client could afford to take the time to watch and see what was going on before moving. However, the adviser explained that the current “bad market moment” was decreasing the value of the assets, so the client could transfer more. The value will eventually increase, to the benefit of the beneficiaries, when the market goes up.

The convergence of the current economy and the possible future loss of the exemption is stimulating activity.

“I’ve yet to meet anyone who says, ‘Oh my God, I may not be able to buy eggs and milk because my wallet is down to $8 million,'” Olivieri said. “I don’t understand that, but I get, ‘OK, that’s an anomaly, the big market declines, what can we do with that?’ When you combine that with a potential exemption loss, a number of people say, “The time to act is now, because if we wait until 2025, maybe the market will pick up.”

At Dinsmore & Shohl, partner Kent Broach doesn’t get panicked calls from clients either, but their uncertainty prompts him to build flexibility into estate planning documents.

Customers are seeing the opportunity to donate now, when asset values are “just being beaten,” Broach said. Over time, the economy will reverse and the value will increase, so transferring the wealth will remove that appreciation from their taxable wealth.

Broach educates clients on the various financial tools available and how they work, sometimes keeping flowcharts handy as visual aids. He has conversations and advises them, but when the estate papers are ready to be signed, they hesitate.

“A lot of times I meet with clients and we look at some scheduling options and then they don’t do anything,” Broach said. “It’s easy to hide from that and not want to think about it. It happens quite often. »

Inaction on the Hill

Congress has given no indication of what it will do, though a bipartisan plan seems unimaginable. House Democrats were discussing in 2021 the possibility of reducing the exemption even further to $5 million, while Republicans have long called for the total abolition of the estate tax.

Another factor that could play into discussions about extending the sunset is government spending. Duncan pointed out that the exemption diverted tax revenue from federal coffers at a time when Capitol Hill was doling out money to support families during the worst of the COVID-19 pandemic.

Therefore, it can be difficult to get “Congress to be very sympathetic to” a small group of wealthy people who get a higher exemption when the national debt raises concerns, he said. -he declares.

Therefore, it can be difficult to get “Congress to be very sympathetic to” a small group of wealthy people who get a higher exemption when the national debt raises concerns, he said. -he declares.

The Center on Budget and Policy Priorities criticized the 2017 law for its limited impact. Namely, the CBPP blamed the exemption for benefiting the wealthiest, costing $1.9 trillion in lost income, and expanding opportunities for “wealthy people to game the tax system.”

Calling the loss of tax revenue “irresponsible”, the organization pointed to tax challenges ahead. The country will need financial resources to deal with an aging population, health care costs, interest rates returning to more normal levels, national security as well as infrastructure needs.

Broach countered that in the case of small businesses, the exemption may stimulate more than the owners. He gave the example of parents who pass on their business to their children who are then able to grow and expand the operation.

“As the business just clicks, it’s good for the economy, it’s good for the employees, it’s good for the family,” Broach said.

Business cost

Dan Rosio, partner in charge of Katz Sapper & Miller’s appraisal services group, said he was only sure any action on the exemption by Congress would come later than sooner.

“It’s hard to predict anything,” Rosio said. “You can’t predict what Congress is going to do, but my main prediction is that they usually don’t do anything until the very last minute.”

The people who aren’t waiting are the baby boomers who have their wealth in their businesses and no heirs want to take over. They clung to their businesses during the Great Recession and have continued to unlock doors and turn on lights every day since.

But Rosio said he sees owners in every industry, from trucking and construction to real estate and health care, who realize the market has diminished the value of their businesses but are still selling. That created a boiling deal market that Rosio said he didn’t expect to cool.

Business owners take advantage of the private equity money to sell before the exemption expires and the top tax rate rises to 39.6%. Yet the main reason for retirement is fatigue.

“When clients call me for appraisal work, those who want to sell, they basically tell me, ‘We’re just tired of doing this,’” Rosio said. “…Not only are they running the business, but they just had to survive those 2 and a half years of utter chaos. And clients call me and say, “We just finished. We just want to sell it and get it over with.

Looking at his calendar, Olivieri said he expects December 2025 to be very busy as people try to outrun the sunset. He tries to avoid a rush by advising his clients to transfer now.

“If you make a big donation before the exemption goes away and it turns out it doesn’t go away and ends up with your kids where you wanted it anyway, there’s no no harm, no fault,” he explained. “But if you don’t give it, you could really get hurt.”•